A Note about Life Cycle Cost Modeling

SelecTie III is a comprehensive life cycle costing model for comparing alternative tie types. The model was developed to consider costs that are effected by the type of tie used in track and consider its costs and benefits. For any life cycle costing model, the stream of costs that are incurred must be considered. SelecTie III handles these cost streams in perpetuity as they occur, considering the time value of money. The model is very flexible and almost any construction and maintenance scenario can be simulated with SelecTie III.

Cost Streams

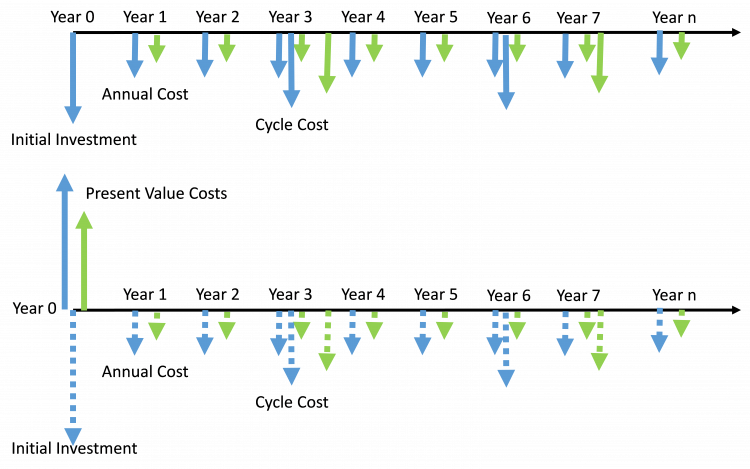

Costs are incurred initially, annually or on a time cycle as shown below:

The figure shows a comparison of two cost streams (blue and green). The top timeline shows an Initial Investment, Annual Costs for each stream (blue and green) and a Cycle Cost for each (blue every 3 years, green every 3.5 years). The length of the arrow is indicative of the magnitude of the cost. A life cycle costing model takes these costs and brings them back to a present value base on the cost of money (interest rate), i.e., a cost of $1.00 in year 10 is only worth $0.39 today for an interest rate of 10%. The bottom timeline illustrates that all future costs brought back to present value show a higher PV cost for the blue stream versus the green stream.

SelecTie III considers all cost streams based on the per mile cost and the life cycle and when they will initiate (life left). In other words, if rail costs $200,000 per mile to install and lasts 20 years, then for brand new track, a $200,000 cost for rail replacement will occur in year 20, 40, 60, 80 …. This corresponds to a PV cost of $34,919. Note this assumes that the initial investment is already absorbed (life left = 30). If the track is being newly constructed, then there is an initial investment of $200,000 in year 0, thus the PV cost for rail replacement would be $234,919. In this manner, SelecTie builds up investments and maintenance cost streams for each tie type and brings them to a present value.

Net Benefit and ROI

In order to compare one scenario to another, a net benefit and return on investment (ROI) are calculated. The net benefit is the PV difference between the alternate tie type minus the wood tie costs. The ROI = Net Benefit/Investment. A negative ROI results in a negative return on investment of the alternate tie material.

Depending on the scenario being analyzed, an initial investment may not exist in which case the ROI does not exist. In this cases the Net benefit should be evaluated. A positive Net Benefit shows a benefit for Wood ties.

Return to main Help page.